|

Analytics

|

We provide clients with complete, objective and unbiased analysis. A close collaboration between our analysts and brokers enables us to harness these tools to provide the most effective reinsurance solutions for our clients.

The insurance and reinsurance industry is increasingly adopting a more sophisticated approach to solvency, including Solvency II and similar initiatives. AHJ’s resources help our clients' meet these challenges.

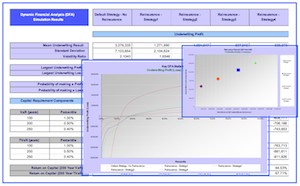

Dynamic financial analysis (DFA) is a risk management and modelling approach that utilises stochastic simulations to produce a wide variety of possible financial scenarios with associated probabilities. DFA is a principle method we use to evaluate optimum reinsurance strategies, counterparty credit risk and capital requirements.

AHJ have a flexible approach to DFA solvency modelling, combining the financial analysis tool ‘Risk Explorer’ with bespoke actuarial based models tailored to the individual requirements of specific cases. We are thus able to evaluate our clients’ reinsurance programmes, analysing the risk (capital requirements) versus reward (bottom line underwriting profit) of different risk transfer strategies.

We have a cooperation agreement with the consultancy firm James Brennan & Associates, who provide additional analytical and actuarial knowledge and resources.

AHJ licenses the three industry leading catastrophe modelling systems. We take a dynamic approach to modelling catastrophe perils, which helps us to provide our clients with a clear understanding of their risk environment.

We have an analytical team with a proven track record of building, running and calibrating modelling systems. They work as an integral part of our client broking teams which helps us to take a questioning approach to the cat models. We carry out extensive research into the interaction between model parameters and benchmarking against actual experience.

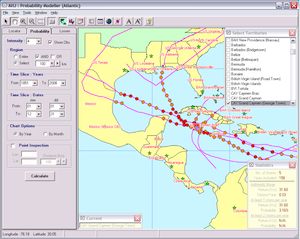

AHJ have also developed a number of proprietory modelling tools, tailored specifically to our clients’ business needs. These include a suite of experience, exposure and capital adequacy modules. Furthermore, we have developed AHJ Probability Modeller, a custom built GIS based programme for the analysis of hurricanes in the Atlantic Basin and the East and West Pacific.

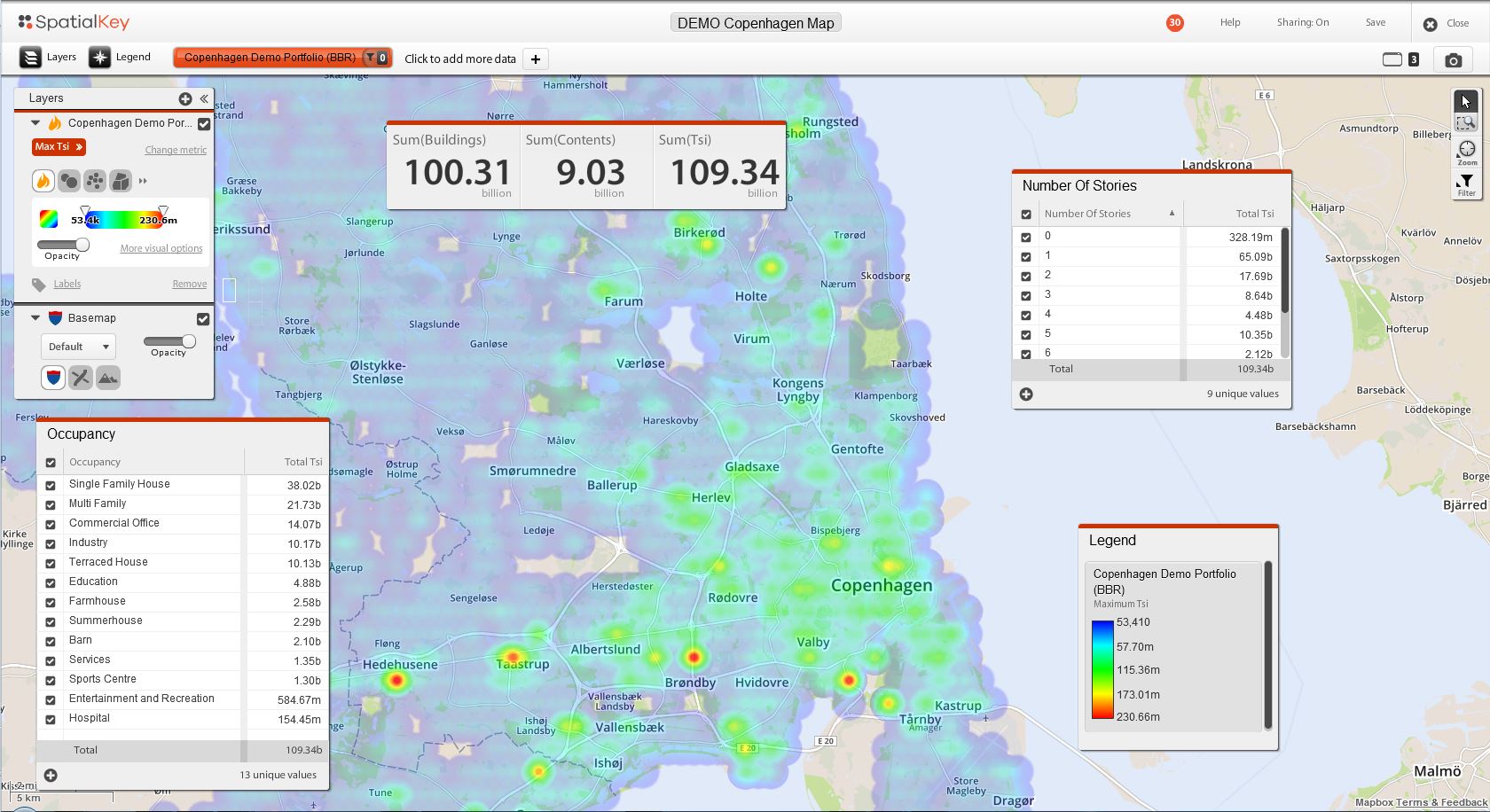

Increasing our investment in the latest innovative software solutions, AHJ have licensed the interactive web based mapping and analysis software SpatialKey. The SpatialKey solution enables us to perform portfolio, accumulation and hazard analyses of our clients’ portfolios. For example we are able to find the highest accumulation within a 200m radius, now a key requirement under the Solvency II for man-made cat scenarios.